* The information contained herein has been prepared for general informational purposes only, and it is not intended to provide, and should not be relied on for, tax, legal or accounting advice. All persons are directed to seek the advice of an attorney regarding their specific tax and legal situation.

New Changes may Benefit many Homeowners

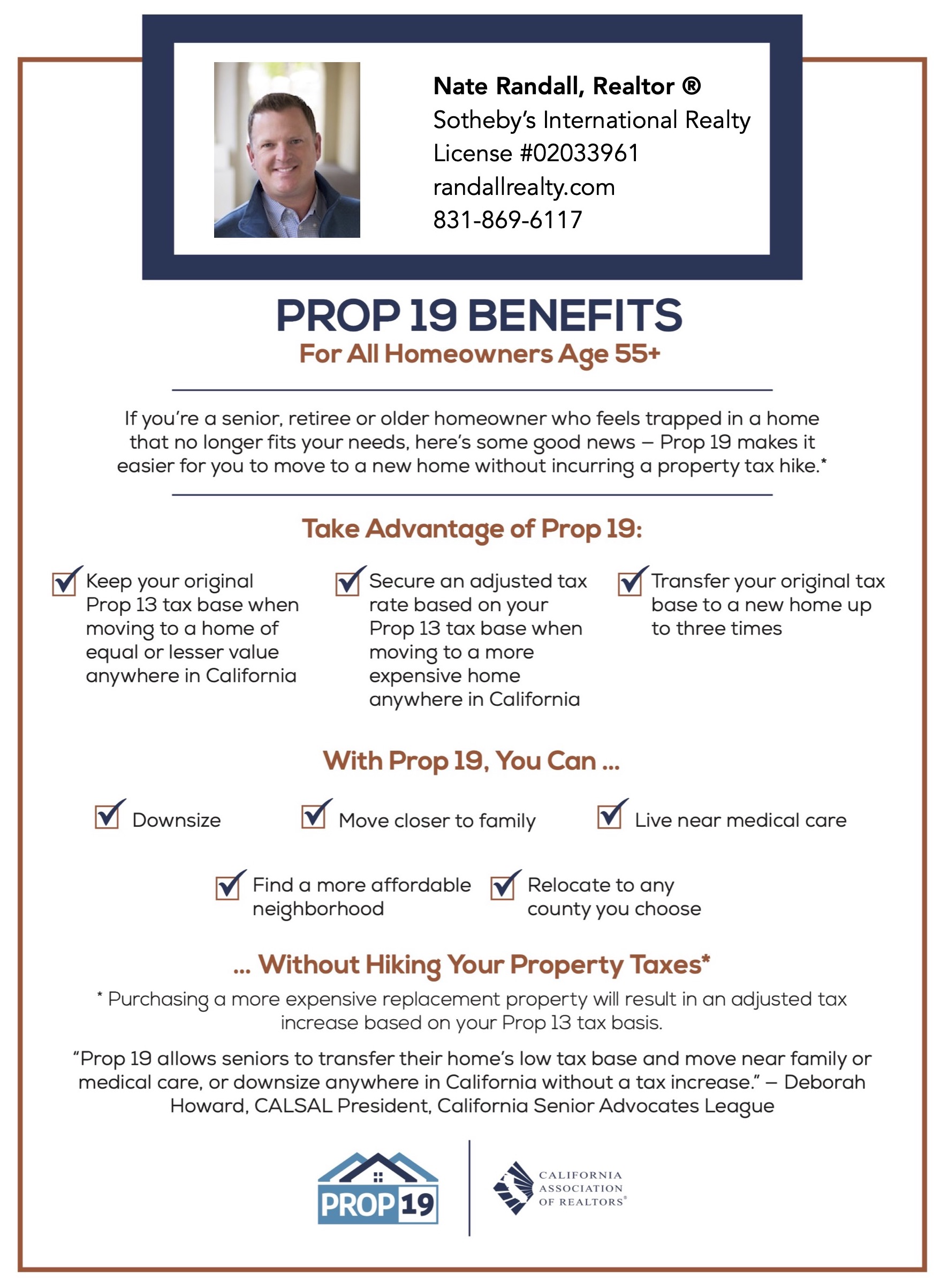

Have you thought about moving but are worried about property tax increases? If so, I have good news to share with you. There are new tax benefits you could be qualified to take advantage of that may allow you to move without big tax increases.

* All information in this article is quoted directly from the following sources:

California Association of Realtors®

California State Board of Equalization

Monterey County Assessor’s Office

With the passage of Proposition 19, homeowners who are 55+, severely disabled or victims of wildfire or natural disastermay transfer their property tax base of their existing home to a new home anywhere in California. This is a significant improvement from the previous law, which many considered confusing, unfair and limiting.

What are Some of the Main Benefits of Proposition 19?

- Homeowners who are 55+ or severely disabled can transfer the property tax base of their existing home to another home anywhere in California, regardless of price, to be closer to family or medical care, downsize, or move to a home that better meets their needs without a property tax increase (with an adjustment upward to their tax basis if the replacement property is of greater value).

- Allows wildfire victims to transfer the property tax base of their damaged home to a replacement home anywhere in California.

- Creates housing opportunities to build more senior housing and retirement communities for millions of seniors and Baby Boomers to retire with Prop 19’s tax benefits.

- Opens up more housing inventory in neighborhoods throughout California, providing homeownership opportunities for renters, young families, and first-time homeowners.

*quoted source: https://www.caprop19.org/

What are Some of the Main FAQs of Proposition 19?

- Moving anywhere in California: Prop 19 removes location restrictions on property tax transfers allowing the transfer of the property tax base of an existing home to a new home anywhere in California.

- Moving to any home regardless of price: Prop 19 removes price restrictions on property tax transfers allowing the transfer of the property tax base of an existing home to a new home regardless of price (with an adjustment upward to their tax basis if the replacement property is of greater value).

- If the purchase price of the replacement home is equal to (or less than) the sales price of the existing home, even if the replacement home is in another county, the tax base of the replacement home will remain the same as the original residence.

- If the purchase price of the replacement home costs more than the sales price of the existing home, qualified homeowners can blend the tax base of their original home with the tax base of the new home. The new, adjusted property tax base of the replacement home takes the tax base of the original home and adds the difference between the sale price of the new home and the original home.

- Transfer the low property tax base of your original home to a new home up to three times (or more for victims of wildfire or natural hazard).

- The original property and the replacement property must be the principal residence of the homeowner.

- Replacement residence must be purchased or newly constructed within two years of the sale of the original property.

- Both the original and replacement properties must be eligible for the homeowners’ or disabled veterans’ exemption. The claimant must own and reside in the original property at the time of its sale or within two years of the purchase or new construction of the replacement.

*quoted sources:

https://www.boe.ca.gov/pdf/pub801.pdf

https://www.boe.ca.gov/prop19/#FAQs

Increased Inventory for Young Families & First-Time Buyers

According to the California Association of Realtors, “Millions of older homeowners feel trapped in homes that no longer meet their needs — they want to move to senior housing or retirement communities, or downsize to smaller homes. Prop 19 lets them move without a tax penalty (With an adjustment upward in the tax basis if the replacement property is of greater value). As more seniors take advantage of Prop 19’s tax savings, homeownership opportunities will open up each year for renters, young families, and first-time homebuyers in communities throughout California.”

Ready to Make the Move?

If you are thinking you might want to sell your home, now may be the perfect time. I will be happy to provide you a custom market analysis of your home’s value, execute a tailored plan of action to sell your home for the absolute best price possible, help you secure the perfect replacement property and coordinate the details — all the while delivering A+ results and minimizing any hassle for you. Please feel free to give me a call at 831-869-6117 to discuss your goals at no obligation.

* As a reminder, the information contained herein has been prepared for general informational purposes only, and it is not intended to provide, and should not be relied on for, tax, legal or accounting advice. All persons are directed to seek the advice of an attorney regarding their specific tax and legal situation.

Leave a Reply