* The information contained herein has been prepared for general informational purposes only, and it is not intended to provide, and should not be relied on for, tax, legal or accounting advice. All persons are directed to seek the advice of an attorney regarding their specific tax and legal situation.

Selling a rental property on the Monterey Peninsula

With real estate home prices surging across California over the last several years, many homeowners and investors find themselves sitting on considerable equity. Here on the Monterey Peninsula, luxury market areas including Pacific Grove, Carmel, Monterey and Pebble Beach have seen dramatic growth in property appreciation, and now may be the perfect time to sell your property and get the best price possible.

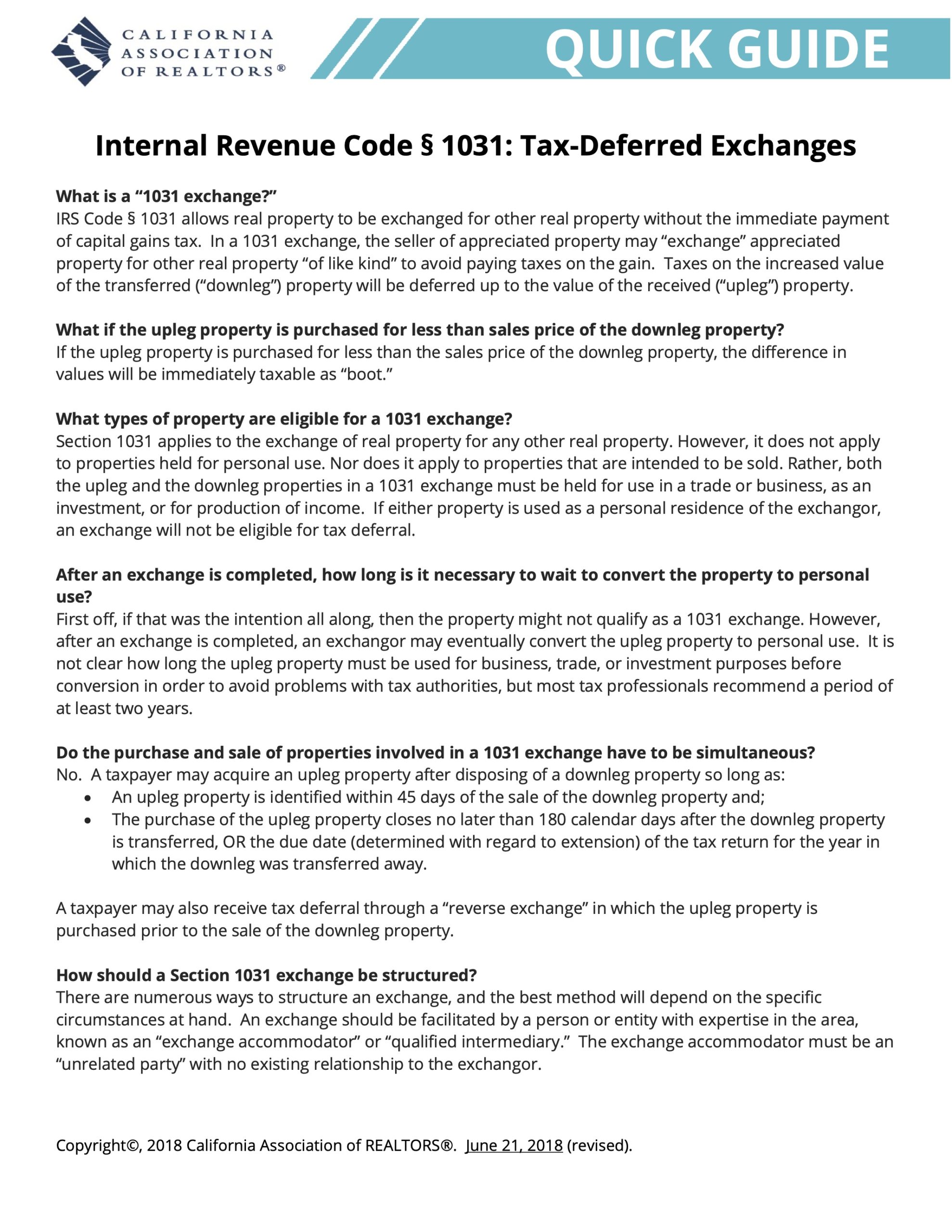

For those of you looking to buy or sell an investment or rental property in Monterey County, it may be possible to defer capital gains tax by using a “1031 tax-deferred exchange.” You would want to consult your CPA or attorney about this.

According to the California Association of Realtors, “IRS Code § 1031 allows real property to be exchanged for other real property without the immediate payment of capital gains tax. In a 1031 exchange, the seller of appreciated property may “exchange” appreciated property for other real property “of like kind” to avoid paying taxes on the gain. Taxes on the increased value of the transferred (“downleg”) property will be deferred up to the value of the received (“upleg”) property.”

Source: California Association of Realtors Quick Guide

Selling a rental property on the Monterey Peninsula

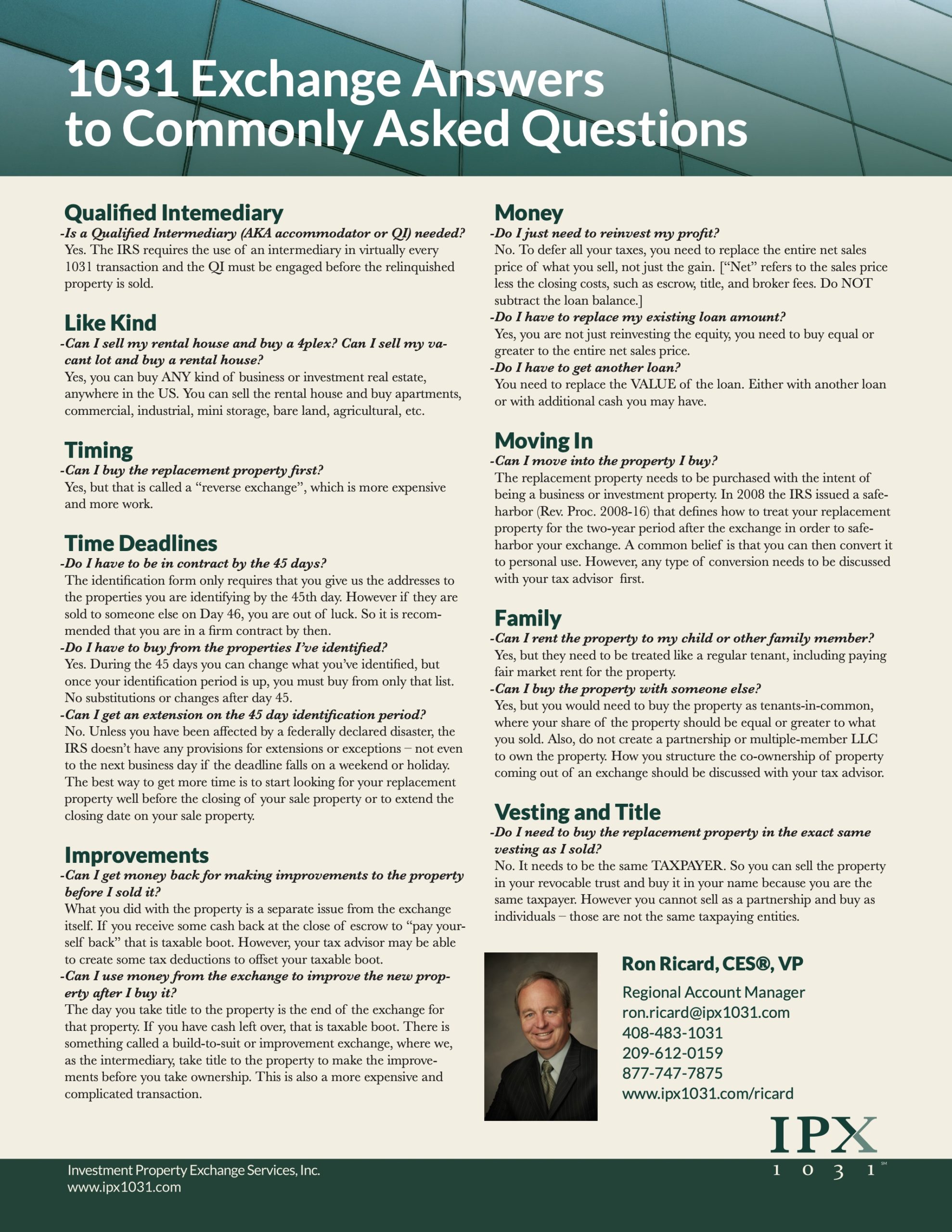

There are a number of factors to consider when deciding to sell a rental property in Monterey County. You may wish to consolidate or diversify your portfolio, or shift markets entirely. Regarding a 1031 Exchange, investors may target possible increased cash flow and/or appreciation. According to IPX1031.com, “Following a like-kind exchange, the owner of business use or investment real estate (“investor”) has more capital to acquire replacement real estate. This may result in increasing cash flow and/or increasing appreciation potential of the asset. In addition, the economy benefits because the investor cannot receive full tax deferral without fully reinvesting into the replacement property. “

Source: IPX1031.com

What should I consider if I want to buy a rental property in an area like Carmel or Pacific Grove?

The Monterey Peninsula is a trending market and very desirable place to live. Bolstered by highly rated school districts and a strong military community from the Defense Language Institute and Naval Post Graduate School, the Monterey Peninsula rental property market is highly competitive. Furthermore, we are seeing unprecedented recent appreciation in home values. Both of these factors make the Monterey Peninsula a desirable target for real estate investors. There are some great opportunities waiting for you; however, whether you are looking for a multi-family income property in Monterey or a single-family rental cottage in Pacific Grove, you won’t find everything online — a portion of our inventory is off-market. You can give me a call at 831-869-6117 to discuss your goals and I can provide you a list of off-market inventory.

Ready to Make the Move

If you are thinking you might want to sell your home and buy an investment property, now may be the perfect time. For any tax and legal questions, you will consult your CPA or attorney. I will be happy to provide you a custom market analysis of your home’s value, execute a tailored plan of action to sell your home for the absolute best price possible, help you secure the perfect replacement property and coordinate the move — all the while delivering A+ results and minimizing any hassle for you. Please feel free to give me a call at 831-869-6117 to discuss your goals at no obligation.

* As a reminder, the information contained herein has been prepared for general informational purposes only, and it is not intended to provide, and should not be relied on for, tax, legal or accounting advice. All persons are directed to seek the advice of an attorney regarding their specific tax and legal situation.

Leave a Reply